In recent months, Nigeria’s inflation rate has surged to 34.19%—the highest in 28 years—and the cost of living has become a heavy burden on the average Nigerian (Stears Analytics). The cost of basic necessities such as food, housing, and transportation has skyrocketed, and has put severe strains on people’s ability to make ends meet. For example, fuel prices have jumped from ₦580 to as high as ₦1,300, reflecting a broader trend of rising costs across the country.

Unfortunately, education is not exempt from the far-reaching effects of inflation. Across the country, school fees have surged, highlighting the need for sustainable solutions. The Lagos State Government, for instance, recently raised boarding school fees from ₦35,000 to ₦100,000 per term (Punch News). This sharp rise begs the question: How much longer can Nigerian families sustain the rising costs of education? With the cost of education tripling in some cases, the Nigerian education system faces dire consequences if inflation remains unchecked.

Source: Statista

It’s important to note that the rates for 2024 and 2025 are marked with asterisks. This indicates that these figures are projections based on past trends rather than actual recorded data. Currently, the inflation rate for 2024, as reported by the National Bureau of Statistics, stands at 34.19%. However, this figure may rise or depreciate as the year progresses.

Understanding Inflation: Focus on Nigeria’s Current Crisis.

The current inflation in Nigeria is driven by a combination of factors such as economic mismanagement, structural inefficiencies, global economic shifts, and the removal of fuel subsidies. One of the most significant drivers has been the country’s overreliance on borrowing to fund public expenditure, particularly for infrastructure and social services. While borrowing is essential for national development, it has often been poorly managed in Nigeria. The International Monetary Fund (IMF) notes that Nigeria spends over 80% of its government revenue on debt servicing, which leaves little for critical investments in education, healthcare, and social services (Punchng). This fiscal mismanagement has compounded inflationary pressures as the government continues to borrow while failing to address key structural issues like inadequate infrastructure and corruption.

The removal of fuel subsidies in 2023, a significant policy change, was aimed at freeing up resources for investment in vital sectors. In 2022, Nigeria spent over $6 billion on fuel subsidies—an unsustainable burden on an already strained economy (Ozili, 2023). However, this policy change has significantly increased the cost of living. Fuel prices surged from ₦165 to over ₦500 per liter and later escalated to around ₦1,300 per liter. These rising fuel costs have triggered cost-push inflation, driving up the prices of transportation, food, and other essential commodities. Consequently, inflation has been exacerbated, making everyday life more difficult for Nigerians, especially those in lower-income brackets.

The removal of subsidies has not been without controversy. While it was expected to lead to increased public investment in infrastructure, education, and healthcare, many Nigerians have yet to see the benefits. It has consequently led to a public outcry, protests, and strikes from labor unions who argue that the policy disproportionately affects the poor. For example, fuel is a critical input for transportation and agriculture, so any price increase directly impacts the cost of goods and services, including food. With inflation already hovering at around 34.1% in June 2024, this policy has intensified economic pressures on households.

Furthermore, the government’s decision to raise the minimum wage from ₦30,000 to ₦70,000, while intended to ease the burden of inflation, has had limited impact. In real terms, the increased wage has not kept pace with the rising costs of goods and services. Coupled with the government’s aim to raise the tax-to-GDP ratio to 18% within three years, many Nigerians fear that the increased tax burden will push more people into extreme poverty (The Guardian News). The government has also failed to significantly improve essential services like healthcare, education, and infrastructure, which would justify such an aggressive tax policy.

Source: Statista

The increase in the minimum wage over the past 7 years has been relatively slow and has not kept pace with the rate of inflation. This lack of correlation between wage growth and inflation means that workers’ purchasing power has diminished over time, making it harder for them to afford basic necessities.

It is already bad that Nigeria is hunted by insecurity that has crippled the agricultural sector of Nigeria, thereby increasing the prices of many farm produce. Nigeria also relies heavily on imports, which compounds the inflation crisis. The country imports a vast majority of its essential goods, including fuel, machinery, and even some food products. Due to global supply chain disruptions, exchange rate volatility, and rising fuel prices, especially after the removal of subsidies, the cost of these imports has surged, further increasing the overall cost of living. Unlike nations that rely on exports to strengthen their economies, Nigeria’s weak export sector—particularly non-oil exports—means the nation has a trade imbalance, and consumers bear the brunt of inflation.

While public borrowing, the removal of subsidies, and fiscal policy reforms can be beneficial for economic growth, their impact in Nigeria has been marred by corruption, mismanagement, and a lack of transparency. These factors have limited the effectiveness of these policies, resulting in inflationary pressures that continue to erode the purchasing power of the average Nigerian, potentially reducing their access to quality services.

How Inflation Affects Educational Access

1. Rising Tuition Costs

Inflation in Nigeria has led to significant increases in tuition fees across both private and public institutions. As operational costs for schools—such as utilities, staff salaries, and maintenance—rise, these expenses are passed on to students in the form of higher tuition fees. For instance, recent reports show that tuition fees in federal universities have surged by over 100% in some cases following the government’s removal of subsidies and other economic adjustments. The Lagos State government recently increased boarding fees from N35,000 to N100,000 per term in secondary schools. These spikes in costs are creating a widening gap between families’ income and educational expenses, which disproportionately affects those with lower incomes. How would a family with three school-going kids, whose parents’ income is pegged at ₦70,000 per month, afford to pay school fees, rent, transport, and feed comfortably?

2. Choice Between Survival and Education in Low-Income Families

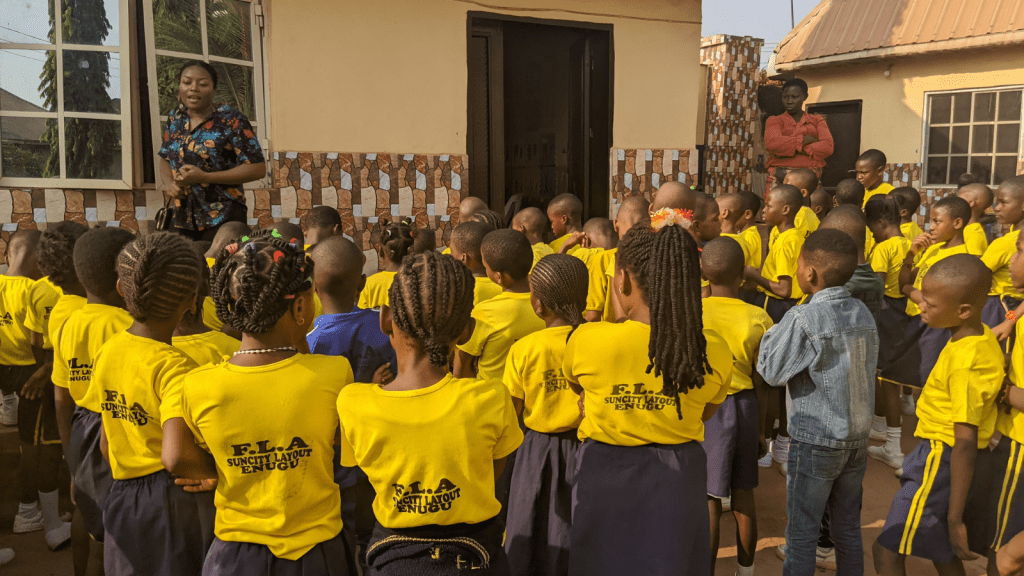

Many parents are already struggling to afford basic needs due to inflation, and the increased cost of education forces them to make tough choices. As a result, there is a rising trend of students dropping out of school due to financial constraints. According to a report by Vanguard, UNICEF estimated that more than 18 million children were out of school in Nigeria before the most recent economic challenges. This figure is expected to rise further due to inflation, with northern Nigeria particularly affected, given the region’s higher poverty rates and insecurity. The disparity between northern and southern Nigeria continues to grow, with fewer children attending school in the north due to ongoing conflict, kidnappings, and lack of infrastructure.

3. Access to Learning Materials

Inflation has not only affected tuition fees but also the cost of textbooks, school supplies, and other learning materials. Textbooks that would ordinarily cost ₦2500 now cost over ₦5000. For most students in tertiary education, their monthly allowances, which once sufficed for basic expenses, now barely cover their needs due to skyrocketing prices. For instance, the cost of food and transportation has doubled or even tripled, which means students must often forego essential materials and services. As families face soaring living expenses, purchasing necessary school supplies will most likely become a lower priority, further hindering students’ ability to participate in their education fully.

4. Educational Divide

The educational gap between northern and southern Nigeria has always been wide, but inflation will worsen this divide. In the north, insecurity has severely impacted school attendance, with armed conflicts, kidnappings, and insurgencies targeting schools. This is compounded by the economic crisis, where families facing poverty are forced to pull their children out of school. It is already known that 65% of poor people living in Nigeria are in the North, while 35% are in the South (National Bureau of Statistics). Southern states, though affected by inflation, have relatively more stable access to education. However, the rising cost of education is squeezing out students from poorer families in the South.

The Impact of Inflation on Educational Quality in Nigeria

1. Teacher Salaries and Quality of Education

Due to the rising cost of living, teachers’ wages have become inadequate to meet basic needs, leading to widespread dissatisfaction with the profession. Teachers’ salaries in Nigeria have not kept pace with inflation despite minimum wage increases to ₦70,000. This remains insufficient in light of the soaring prices of essential goods and services, causing many educators to struggle financially. The situation is even more dire in private schools, where a large number of teachers earn less than ₦50,000 per month—a salary that barely covers their living expenses.

The stagnation in teacher salaries has a direct impact on the quality of education. Low pay results in reduced morale and productivity, with many educators forced to take on second jobs to supplement their income. This extra burden diminishes their ability to focus on teaching, leading to less effective classroom instruction.

Moreover, the lack of financial security has contributed to a significant brain drain in the education sector. Qualified teachers are leaving the profession in large numbers, seeking better-paying opportunities in other sectors or moving abroad (Punchng). This exodus is particularly harmful in a country already grappling with a shortage of educators, further widening the pupil-teacher ratio, which is a key indicator of education quality. According to reports, Nigeria’s current pupil-teacher ratio falls well below international standards, a reality that hampers student learning outcomes (Punchng).

2. School Infrastructure and Resources

Many public schools in Nigeria are in disrepair, lacking essential amenities like functioning toilets, clean water, and well-maintained classrooms. This issue is especially severe in rural and underserved areas, where infrastructure development is often neglected. According to reports, about 50% of schools in rural Nigeria lack access to clean water and sanitation, making it challenging for students to learn in a conducive environment (TVC News). The disparity between urban and rural schools continues to grow, with the latter suffering most from inadequate infrastructure.

Government allocations to education have consistently fallen short of UNESCO’s recommended 15-20% of the national budget. In 2024, Nigeria’s education budget increased to ₦1.54 trillion, representing 6.39% of the total government budget (Premium Times). However, this increase does little to address the effects of inflation and rising costs in the education sector. For comparison, many African countries with similar economic challenges, such as Kenya and Ghana, allocate closer to 20% of their budgets to education.

Schools are also struggling to acquire modern technological resources essential for enhancing learning outcomes. The high cost of importing educational technologies, such as computers, projectors, and internet services, has left many schools unable to provide students with the tools they need for a 21st-century education. As a result, students, particularly those in rural areas, are being left behind in a world where digital literacy is increasingly critical for future success. This technological gap puts Nigerian students at a significant disadvantage compared to their global peers.

3. Learning Outcomes

The impact of inflation on educational quality extends to student learning outcomes in significant ways. Schools facing budget cuts and reduced resources are forced to operate with overcrowded classrooms and lower student-teacher ratios, which severely limits the ability to provide personalized attention and high-quality instruction. In regions across Nigeria, student performance has declined for a variety of reasons, but the lack of funding is a key factor. Research shows that schools with inadequate infrastructure and insufficient teaching resources contribute to poorer academic achievement (Scirp). In such environments, students struggle to concentrate and engage effectively in their studies due to discomfort and lack of essential materials.

Additionally, larger class sizes resulting from budget cuts diminish the quality of education, as teachers find it challenging to cater to the diverse needs of individual students. Schools are also limited in their ability to invest in modern teaching aids or provide extracurricular activities that promote holistic development. Many Nigerian schools lack even basic instructional materials, and those that are available are often outdated and irrelevant to current curricula.

As educational quality deteriorates, the effects are visible in national examinations. For instance, the poor performance in the 2024 Unified Tertiary Matriculation Examination (UTME) was largely attributed to the systemic issues in Nigeria’s educational system. The increasing cost of living, compounded by inflation, puts further strain on already underfunded schools, leaving little room for improvement in the near future. If inflation continues at its current pace, the gap in educational outcomes between well-resourced schools and those in underserved areas will only widen, potentially jeopardizing the future of millions of Nigerian students.

Long-Term Consequences of Inflation on Education

Inflation’s impact on education is far-reaching and goes beyond immediate cost concerns. It threatens to deepen educational inequalities, reduce workforce competency, and hinder national development.

1. Widening Educational Inequality

The educational gap between wealthy and poor families in Nigeria will widen with inflation, exacerbating already existing inequalities. As the cost of living rises, low-income families are increasingly unable to afford basic educational expenses such as tuition fees, textbooks, and other learning materials. In contrast, wealthier families can absorb the rising costs without significant strain, allowing their children to access higher-quality education. This growing divide threatens to create a bifurcated system where only the affluent can afford the benefits of a well-resourced education.

The inflationary pressures on education are particularly harmful in developing countries like Nigeria, where the socioeconomic divide is pronounced. A 2023 report by UNICEF highlights that children from the poorest families are more likely to be out of school compared to children from wealthier families. This inequality is compounded by geographical disparities, with children in northern Nigeria facing higher barriers to education due to insecurity and poverty. At the same time, southern regions tend to have better access to resources.

Inflation also disproportionately impacts regions with already fragile educational infrastructure. Schools in rural and underserved areas, often underfunded and poorly resourced, face more significant budgetary constraints due to rising prices for materials and operational costs. Wealthier urban schools are more likely to have external funding sources or parental contributions to offset these pressures, further deepening the regional divide in access to quality education.

2. Reduced Workforce Competency

It is easy to overlook the long-term effect of inflation on education and, hence, the labor force. As schools struggle to maintain quality education in the face of shrinking budgets, students are left with inadequate skills and knowledge. A poorly educated workforce poses serious risks to national development, as future workers will lack the critical thinking, problem-solving, and technological skills necessary for the global economy (Online Wrexham).

The correlation between educational attainment and national productivity is significant. A poorly educated workforce directly lowers productivity levels, making it difficult for the country to compete in the increasingly knowledge-based global economy. This has been echoed in multiple reports, including the World Economic Forum’s Global Competitiveness Report, which highlights that countries with better-educated populations tend to have more robust economies.

Inflation not only affects the public sector but also deters private-sector investment in education. Businesses that would typically support educational initiatives, such as scholarships or partnerships, may reduce their involvement due to inflationary pressures on their own budgets. This withdrawal perpetuates the cycle of underfunding in education, resulting in a poorly skilled workforce that hampers national development and innovation.

Additionally, the skills gap created by inadequate education reduces a country’s ability to attract foreign investment. Investors may hesitate to enter markets where the workforce lacks the necessary competencies to drive productivity, which could have long-lasting negative implications for national development. The ripple effects extend far beyond the classroom, threatening the country’s future growth and global competitiveness (World Bank, 2023).

Mitigation Strategies and Solutions

1. Government Intervention

The government has a critical role in addressing the impact of inflation on education by both controlling inflation and increasing support for the education sector. One of the main strategies is to look into others ways of subsidizing education in public schools to help alleviate the financial burden on families and make education more affordable for all. This could be in the form of providing monthly teaching and hygiene materials to public schools to hidden costs for parents.

Additionally, governments should prioritize increased funding for public education to ensure that schools can maintain high standards in teaching, infrastructure, and learning resources. Meeting or surpassing the UNESCO benchmark of 15-20% of the national budget for education would help maintain the affordability and quality of education. This funding is crucial in combating teacher shortages, improving school facilities, and ensuring smaller class sizes that lead to better learning outcomes.

Another essential governmental action would be to stabilize inflation through monetary and fiscal policies. By controlling inflation, the purchasing power of both parents and educational institutions could be better protected, allowing them to meet rising costs without compromising on quality.

2. Private Sector and NGO Involvement

While government intervention is critical, the private sector and non-governmental organizations (NGOs) can also play a vital role in mitigating the effects of inflation on education. Nonprofits and private institutions can offer scholarships, grants, and educational resources targeted at students from low-income backgrounds who may struggle to afford rising school fees or additional expenses such as books, uniforms, and transport.

Additionally, private foundations and businesses can support infrastructure development and educational programs. By partnering with schools or government bodies, they can help fund the construction of classrooms, libraries, and technological labs, ensuring that students still have access to quality learning environments despite economic challenges.

NGOs are especially crucial in rural and underserved communities, where government support may be limited, offering educational resources and supplemental training programs for teachers.

3. Inflation-Adjusted Scholarships and Loans

In times of high inflation, scholarships, grants, and student loans need to be restructured to account for the rising cost of education. Traditional financial aid packages may no longer be sufficient as tuition, textbooks, and living expenses increase. Therefore, advocacy for inflation-adjusted scholarships and loans is crucial.

These financial aid solutions would involve adjusting scholarship amounts and loan limits to match the rate of inflation, ensuring that students can cover the actual costs of their education. Governments, private institutions, and donor organizations need to regularly review and adjust financial aid packages to ensure they meet the needs of students in the current economic climate.

4. Technological Solutions

In response to inflationary pressures, many are turning to online learning as a more affordable and accessible option. E-learning platforms provide flexible and cost-effective alternatives to traditional classroom-based learning. Students can access lectures, tutorials, and course materials from anywhere, which can help reduce expenses related to transportation, accommodation, and even textbooks.

However, for online learning to be a viable solution in low-income regions, there is a need to invest in e-learning infrastructure, such as stable internet connections, devices for students, and online platforms that facilitate interaction and feedback. Governments and private companies can collaborate to create affordable digital education solutions, ensuring that students continue learning despite financial constraints or inflation.

Public-private partnerships can help bridge the digital divide, especially in rural areas, by providing devices, affordable data packages, or setting up community learning centers equipped with necessary technology.

Conclusion

The impact of inflation on Nigeria’s educational system is undeniable, and it poses a significant threat to both access and quality. If left unaddressed, the rising costs will continue to deepened inequalities between wealthy and underprivileged students, with many families unable to afford basic school necessities, let alone tuition. It could also have other long-term consequences for Nigeria’s workforce and national development. A poorly educated population limits the country’s potential for economic growth and global competitiveness. To mitigate these challenges, there is an urgent need for multi-sectoral interventions, including government reforms, private sector involvement, and innovative financial solutions to support both educators and students.

Leave a comment